Residential Investors

Passive Income Being A Private Lender, Be the Bank.

Private Lenders Work

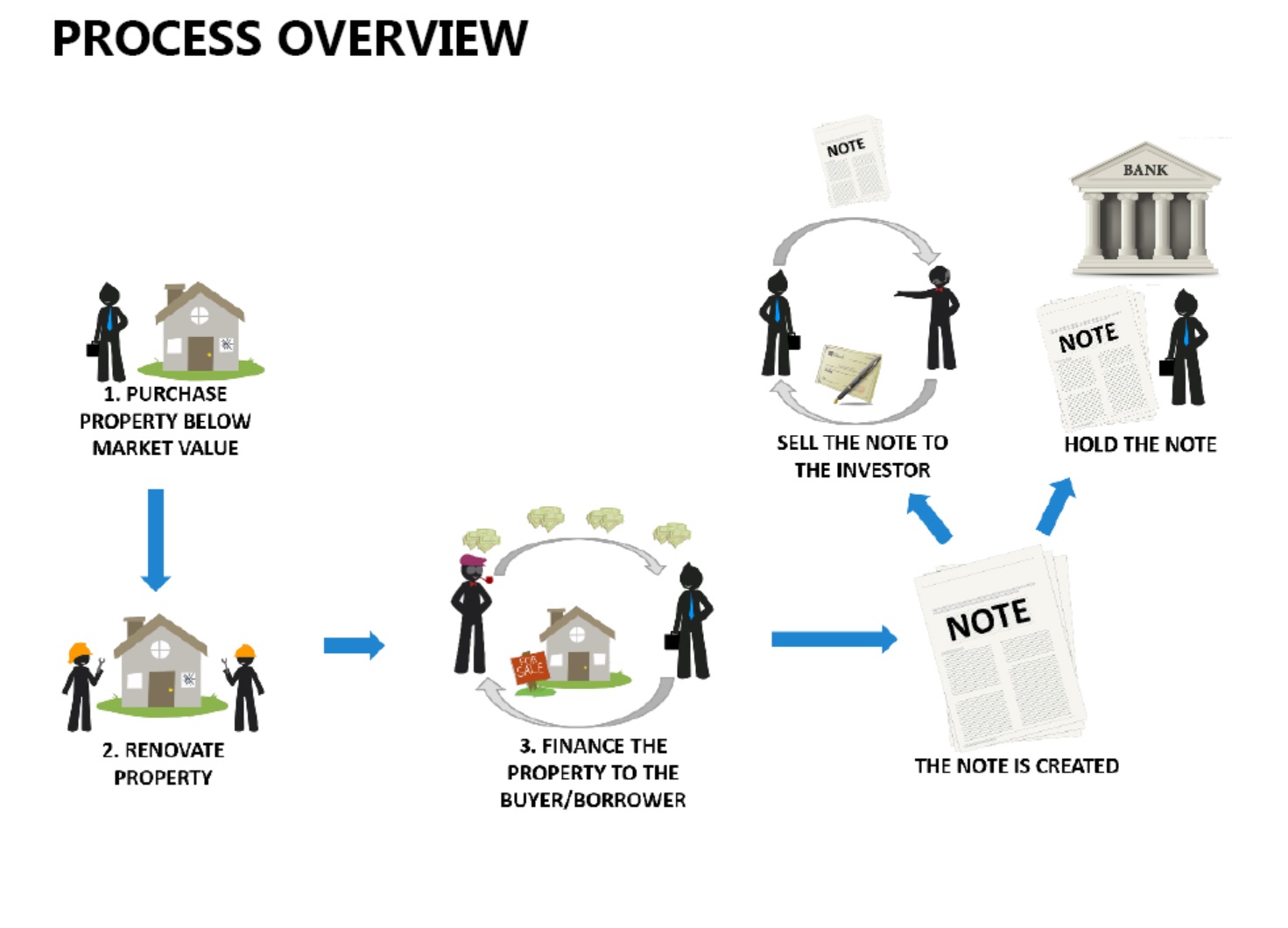

The private lender typically secures their investment using a note and mortgage or another type of security instrument, receiving a return on investment, equity split, or possibly a combination of both in return.

Typically, the more influence or control you have on an investment, the greater the potential for return. For example, when Warren Buffett invests in a company, he is able to utilize his resources and intelligence to help it run better and become more profitable. He’s done this time and time again on his journey to being one of the wealthiest people in the world.

Collateral

“Asset-backed” means that if someone defaults on the loan, the lender receives something in return as payback. The note is “collateralized.” In the case of a mortgage, the loan is collateralized against the actual home. If you default on your mortgage payments, the bank will foreclose on the property and take ownership.

Real Estate Notes

The word “performing” here refers to the fact that the borrower is making consistent payments and the loan is not in default. The investor is able to purchase the note for a certain sum and start receiving the payments. You (the investor) are essentially the bank that holds the mortgage loan and the borrower is paying it off. This can result in a steady stream of passive income for the remaining term.

Many of these notes were created by “seller financing,” where the transaction happened outside of a bank, directly between two parties.

Who can be a private money lender

Private money loans are typically created by people the investor or borrower knows personally, such as a family member, friend, neighbor, or colleague. However, anyone who has idle money they would like to receive a better return on than their savings account interest rate is yielding can become a private lender. Private money lending is great for individuals who:

Have idle money or a surplus of cash sitting in a savings account receiving little to no return.

Have a sizable retirement savings account like an individual retirement account (IRA) or 401k that they want to continuously grow.

Are looking for passive income or want to participate in the real estate market without actively working in it.